He designed the architecture of our global managed investments platform, including its Citi Investment Management unit, and our distinctive private equity, real estate, hedge fund and traditional investment teams. Learn moreĭavid has overall responsibility for Citi Global Wealth Investments, which unifies the Investments teams of the Private Bank and the Consumer Bank worldwide.Īs Chief Investment Officer, David ensures the integration of our asset allocation, manager research and portfolio management teams, and offers his perspectives on the markets.ĭavid joined the Private Bank in 2009 as the Global Head of Managed Investments.

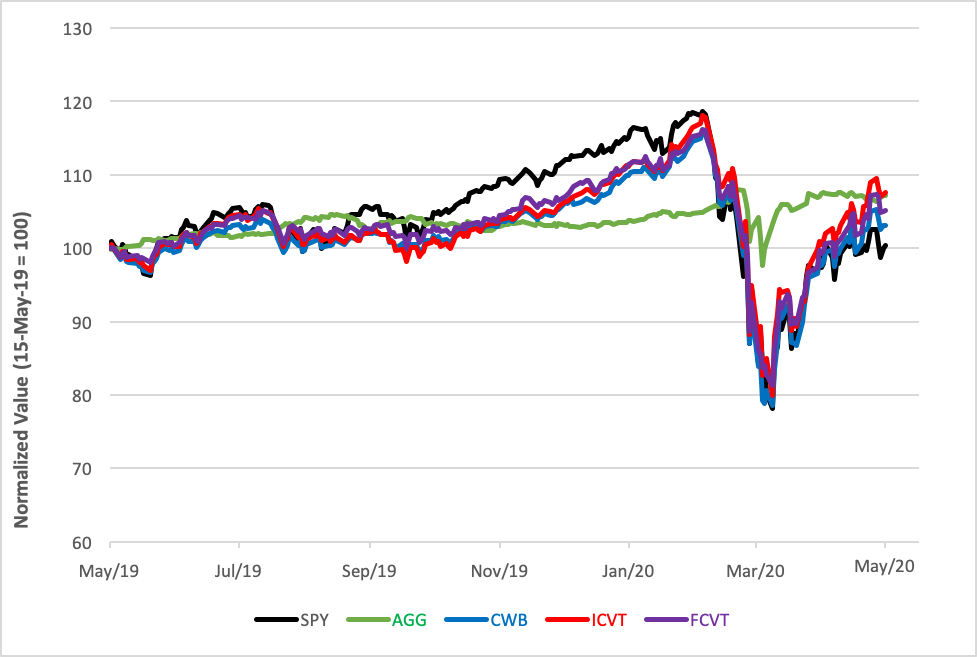

This disciplined approach to asset allocation and portfolio oversight enables you to remain fully invested for the long term.įor deeper insights into your core and opportunistic portfolios, our Global Investment Lab can perform a bespoke analysis to highlight risk exposures and potential opportunities. Our discretionary managers also provide regular rebalancing and systematic risk management.

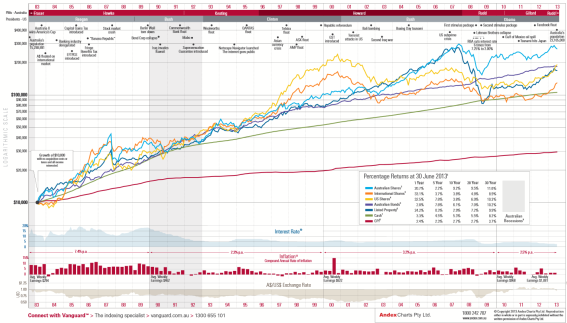

The resulting allocations are tactically adjusted to reflect the recommendations of our Global Investment Committee. Our methodology also treats severe losses during a market crisis – rather than volatility – as the most significant risk that you face. Higher return estimates likely lead to larger recommended allocations to an asset class, and lower estimates to small allocations. Our proprietary strategic asset allocation methodology estimates returns over a ten-year horizon based on valuations. Your return goals, risk tolerance, and other criteria frame the strategic asset allocation we customize for you.

0 kommentar(er)

0 kommentar(er)